how are rsus taxed in the uk

As a result of withholding taxes you shall receive the net amount. If the employee received the RSU for free the employment tax charge would be 80.

If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income.

. You will be subject to capital gains tax at a flat rate of currently 18 when you subsequently sell any shares acquired at vesting of the restricted stock units at a gain. At this point the employee is charged to income tax on 30. How Are Restricted Stock Units RSUs Taxed.

RSU vested in 202122 tax year. In all cases there is no tax to pay when RSUs are granted. Total Tax and NIC.

Related

Capital gains tax CGT breakdown. You pay no CGT on the first 12300 that you make. Less National Insurance 2-345.

Less Employer National Insurance 138-2760. The tax payment is usually the last step before the shares eg. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen.

On the restriction lifting the share is now worth 200. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Top of page RSUs that provide cash on vesting.

The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would. A RSUs isnt taxable when it is granted in any case. Taxation of RSUs.

Extra tax of 4310 due to loss of personal allowance as income above 100000 Employee NIC 2 431. RSUs are taxed as income to you when they vest. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

The taxable amount will be the fair market value of the shares issued to you at vesting. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

Unlike a salary that is subject to taxes RSUs in the UK are tax-free. On vesting a proportion was sold by the company on my behalf to cover the taxes the proceeds of which were submitted to HMRC. Employers have the discretion to either pay this themself.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. You will owe income tax both federal and state if. Shares tax will be paid in advance.

Restricted Stock Units RSUs Capital Gains Tax. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always coincide the value of the stock at that vesting date gets included in your income for the year as compensation. The loss from the sale of shares can be carried forward up to 5 years.

I have Restricted Stock Units RSUs which I received from the company I work for. Salary 100000 RSU Value 25000. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is.

To calculate Capital Gains Tax for the sale. RSUs are free of tax from the start. Less 60 Income Tax 40 Higher Rate Tax plus Loss of Personal Allowance-10344.

Employee total salary before RSU is 100000. For tax purposes RSUs are not taxable. Net RSU Value Before Employer Income Tax NI.

However its still important to understand and manage it appropriately. US RSUs vested and sufficient shares were sold to cover the 47 tax withholding obligation plus commission and fees. You pay 1286 at 20 tax rate on the remaining 6430 of your capital.

Because there is no actual stock issued at grant no Section 83 b election is permitted. Residual Value After All Tax. So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5.

Income tax 40 of Remaining 8620. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward.

Taxes at RSU Vesting When You Take Ownership of Stock Grants. Acquiring RSUs RSUs are not taxable when they are granted. You only pay tax on RSUs when they vest.

50 Tax and NIC paid. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000. For tax purposes RSUs are not taxable.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The proceeds from this sale were used to pay the UK tax and NI charged through the UK payroll when the total value of. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part.

How Are Rsus Taxed In The Uk. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due.

However HMRC is generally prepared to reduce the UK tax liability to reflect the relative number of workdays that you have spent in the UK and the other country between grant and vesting of the option and the subsequent grant and vesting of the restricted stock units except where there. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. Please may I have advice on the following.

When your RSUs vest you will pay income tax and employee national insurance. You pay 127 at 10 tax rate for the next 1270 of your capital gains. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance.

RSUs are free of tax from the start. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. The UK tax treatment for RSUs is similar to how your salary is taxed.

The United Kingdom pays tax only on RSUs when they vest. You may also need to pay for employers national insurance.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

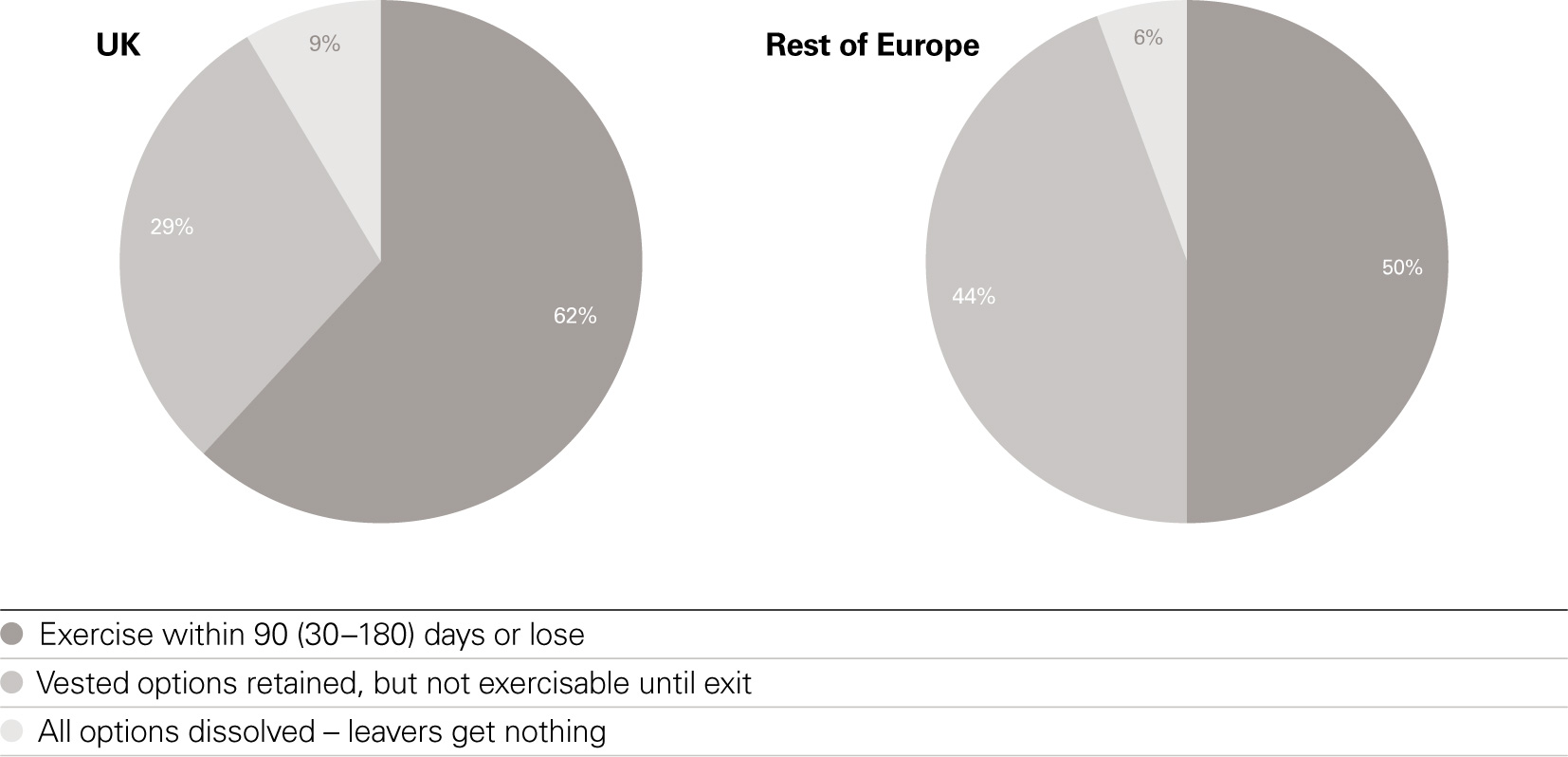

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

Liberating Restricted Stock Units The Rsu Conundrum Tanager Wealth

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

How To Avoid Taxes On Rsus Equity Ftw

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

How Are Restricted Stock Units Taxed In The Uk Ictsd Org

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

United States What Is The Purpose Of An Rsu Tax Offset Personal Finance Money Stack Exchange

How Are Restricted Stock Units Taxed In The Uk Ictsd Org

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

How Are Restricted Stock Units Taxed In The Uk Ictsd Org

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures